E = (TVF+FTA)FTE^UCR

E = Ecosystem

TVF = Top Venture Funds

FTA = Founders Turned Angels

FTE = Full Time Employees

UCR = Under-covered Regions

Successful ecosystems are developed by top venture funds investing alongside founders turned angels into full time employees starting new companies in under-covered regions.

Latam ecosystem overview

How not to love Latin America? Fun music, great food, top soccer and crazy politicians. Most Latam founders have a special sauce called resilience which allows them to survive despite scarce resources and a terrible macro environment. Forecasting the future of the Latam startup ecosystem or predicting which specific company will thrive is impossible, but we can be smarter when picking deals if we understand a few things about the market.

The population size of Latam is 650 million, but 60% is concentrated in three countries: Brazil, Mexico and Colombia. The ecommerce market is expected to grow up to $217 billion by 2026, as 70% of online carts are abandoned at checkout and 80% of the ecommerce market is concentrated in SMBs. In parallel, the fintech market is poised to reach $269 billion by 2025 as 35% of the Latam population is still unbanked and large incumbents have a hard time innovating.

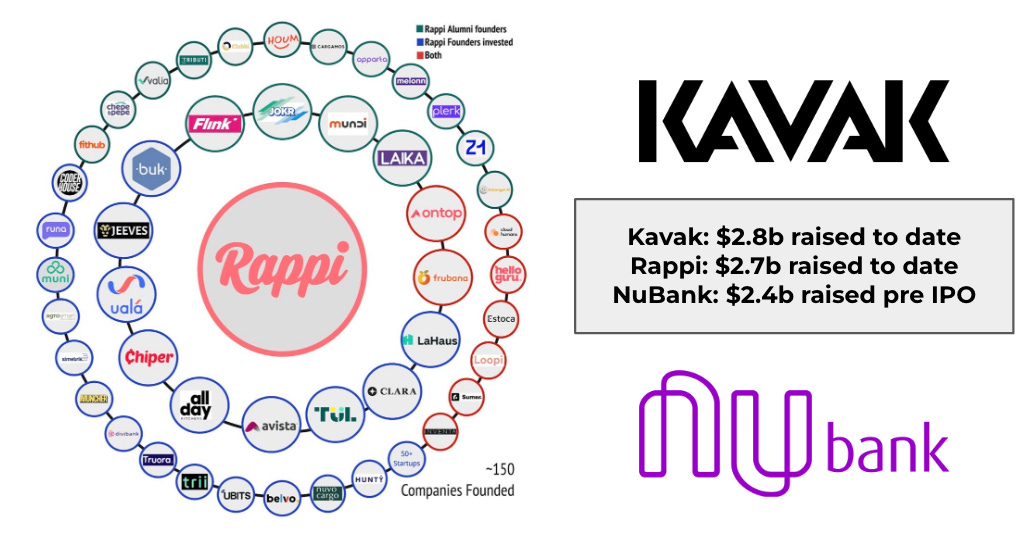

2021 was a record year for Latam with 856 deals and $15 billion invested. ~$10 billion went into ecommerce and fintech, and $3 billions to three specific companies: NuBank, Kavak and Rappi. David, Carlos and Simon - the founders of this successful companies - are now angel investors on past employees that left to start new companies.

If we go a layer deeper in the intersection of ecommerce and fintech we can find a couple of trends worth exploring. First, consumers and companies are more comfortable with exploring ecommerce after Covid, but they are also expecting higher levels of service from every single company they interact with (typical for Latam!) so the infrastructure is critical, both virtual and physical. Ecommerce warehouses and last-mile delivery services are now correctly deployed in populated and chaotic cities, along with gig collaboration marketplaces that power them. In tandem, fintech solutions emerge to offer consumers buy-now-pay-later alternatives, and traditional companies streamline their checkout and payment solutions with data and payment reconciliation softwares on top.

Startups and investors in the space

Latam companies are disrupting ecommerce behind the scenes, focusing on three main pillars very-much-needed to reduce friction and move the industry forward: logistics, commerce, fintech.

In the logistics side, companies like Melon (fulfillment and software services), Fudo (restaurant operating system), Cargamos (same day delivery service), eDarkStore (warehouse and fulfillment enabler), or Muncher (food-tech infrastructure solution) are offering alternatives to both consumers and companies to tap into online delivery.

In the commerce front, innovation is reducing friction through quick and conversational integrations such as Leadsales or Truora, or marketplace empowering gig-workers in Latam such as Zubale or Migrante.

Fintech is probably leading the disruption efforts with companies like Aplazo (buy-now-pay-later software), Belvo (Plaid for LatAm), HolaCash (smart checkout solution), Simetrick (payment reconciliation enabler) or Higo (Venmo for B2B payments in Latam).

“With buyers continuing to embrace digital and self-serve sales channels, organizations need to explore new ways to improve the online buying experience to generate sales” - Kimen Warner, VP of Product Management at Drift

Major players and investors saw this trend coming a while ago in Latam. For example, Travis Kalanick’ CloudKitchens (my former employer) has been quietly acquiring and building an ecommerce infrastructure across the region for more than 3 years. Acquired Hubster and Cocinas Ocultas in Brazil and Colombia (respectively), 100+ properties across the region, and built a bunch of other companies/brands to disrupt the food-delivery market. In addition, tier-1 VCs such as NfX, GFC, Collaborative, a16z, Pear and QED deployed billions into this two verticals last year. Finally, we all remember Uber’s acquisition of Cornershop in Chile for $1.4 billion, which clearly showed how relevant the Latam ecommerce/food-delivery/logistics market became during the past few years.

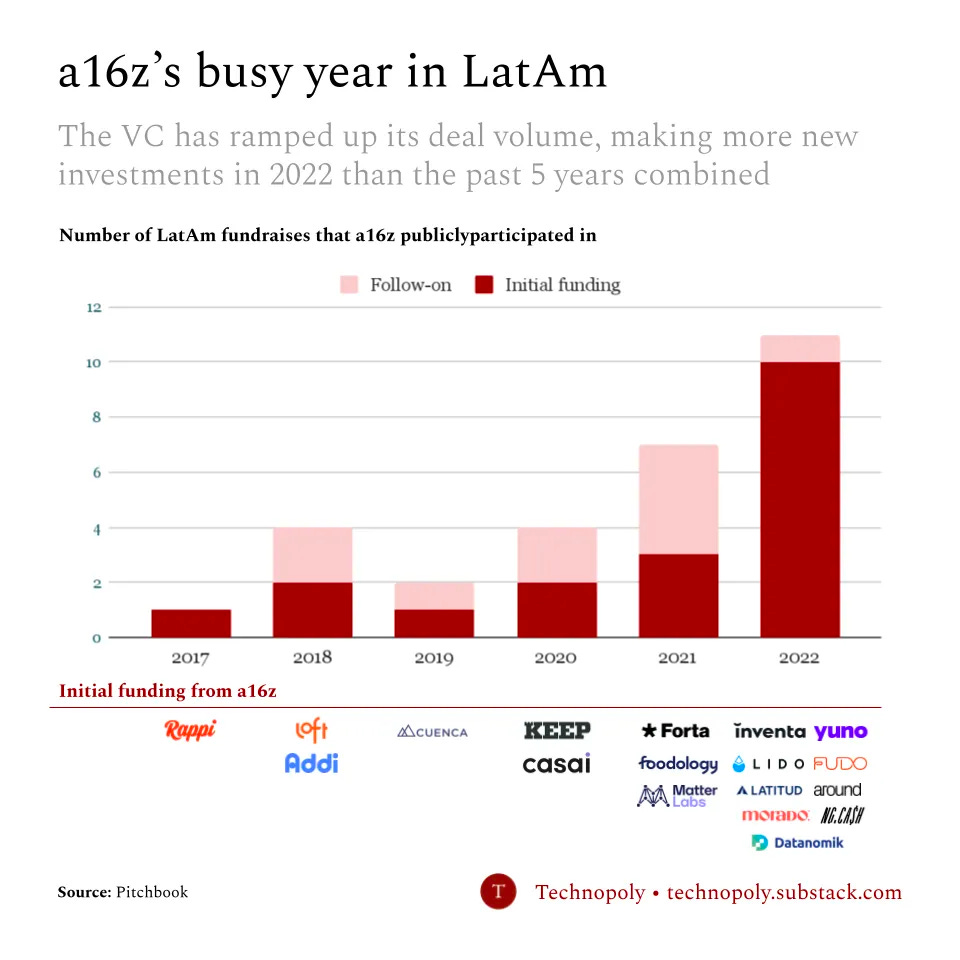

Nevertheless, we should look at this numbers with extreme caution as 2021 was a bubble year for most companies that raised at extremely high valuations, and funds that made exaggerated investment decisions out of FOMO. We see the correction, so it might be a good time to invest, especially in early stage deals (see a16z chart above).

Rationality within a highly connected ecosystem

Investing at the right time/round is as important as picking the right company. As tourists or renters leave and owners double down, the market correction creates a once in a generation opportunity as the wheel of fortune always turns and very little changes over time. With global markets crashing, rationality is restored in a growing region with enormous upside to disrupt incumbents and well-rounded founders turned angles leading the way.

Entrepreneurs that did their homework will manage to navigate this times and position themselves better to redefine industries, win new customers and scale faster across Latam. The total years of accumulated experience gained by full-time employees with 5+ years building successful startups (i.e. hired large teams, scaled internationally, raised large rounds, were acquired or went public) gives massive traction and momentum to the ecosystem.

Funds like a16z are taking more risk by getting involved earlier in Latam (most of their 2022 investments went to new companies vs follow-ons), but deploying capital more efficiently in lower priced rounds with more diverse founders, and alongside a mature group of entrepreneurs that write first checks to former employees (huge validation sign when a manager invests in an employee’s company). This stronger-than-ever network of founders turned angels investing in former employees generates a powerful flywheel.

FDM - First Degree Mafia:

Simon Borrero (founder at Rappi) invested in Morado, Muni, LaHaus

Carlos Garcia (founder at Kavak) invested in Xepelin, Kocomo, Foodology, Cargamos

David Velez (founder at NuBank) invested in Nuvo Cargo, LaHaus, Favo, Beep Saude

SDM - Second Degree Mafia:

Mauricio Suarez (founder at Melon) invested in Ubanku

Santiago Lira (founder at Buk) invested in Transa Tu Auto and Yourney

Nicolas Fuenzalida (founder at Poliglota) invested in Yourney

Daniel Bilbao (former employee at Rappi and founder at Truora) invested in HoyTrabajas

Daniel Vogel (founder at Bitso) invested in Reworth

Alfonso de los Rios (founder at Nowports) invested in Reworth

Ricardo Weder (founder at Jüsto) invested in Reworth

Carolina Garcia (founder at Chiper) invested in Zulu

Man Hei Lou (founder at Treinta) invested in Zulu

Fabian Gomez (former employee at Rappi and founder at Frubana) invested in Morado

Finally, the diversity efforts are getting stronger in Latam as more organizations create opportunities for women-led startups and more capital is invested in their companies:

Amela Tech Club: women founders community led by Michelle Fischman (previously Nazca and Endeavor) that is empowering women led-startups across Latam.

Tarasa Collective: women investors angel syndicate led by Gina Gotthilf, co-founder at Latitud, that includes Allison Campbell (Zubale), Andrea Viejo (Laika), Daniela Izquierdo (Foodology), Eugenia González Rodríguez (Calii), Isabella Bazó (Kavak), Maria Gomez (MUNI), Maria del Mar Velez (Crack The Code), Paola Neira (Latú Seguros).

Companies in the space

Melon (Co) - fulfillment and software services (link)

Fudo (Arg) - restaurant operating system (link)

Cargamos (Mx) - same day delivery service (link)

eDarkStore (Ch) - warehouse and fulfillment (link)

Muncher (Co) - food-tech infrastructure (link)

LeadSales (Mx) - Drift for LatAm (link)

Truora (Co) - CRM for multiple channels (link)

Zubale (Mx) - gig collaboration marketplace (link)

Migrante (Ch) - loans for gig-workers in LatAm (link)

Aplazo (Mx) - buy now, pay later (link)

Belvo (Mx) - Plaid for LatAm (link)

Hola Cash (Mx) - checkout solution for LatAm (link)

Simetrik (Co) - payment reconciliation (link)

Higo (Mx) - Venmo for B2B payments in LatAm (link)

Resources

Rappi mafia: How a delivery startup took over Colombia's tech scene

Top 14 Ecommerce Trends in 2022 (+ Industry Experts' Insight)

Hi! I’m Elias Mufarech, MBA candidate at Berkeley Haas. Thanks for reading Quick-tech - send feedback and tweet me @eliasmufa.