A2A Payments in LatAm

The Account-to-Account payments space in Latin America

Quick summary on the A2A payments space. A2A is short for Account-to-Account, which is essentially electronic money transfers from one bank account into another. These typically do not involve credit or debit cards, but requires an open innovation structure at a country level.

When we talk about A2A, it could be peer to peer (P2P), client to business (C2B), business to client (B2C), business to business (B2B), or me to me (M2M). And typically, there are two ways of processing payments:

How the US payments space evolved?

Push payments (credit): sender initiates transfer

Pull payments (debit): receiver initiates transfer

In the US, ACH payments, short for Automated Clearing House, is the payment rail available to all US account, it is cheap because there is no commission based on a certain service level:

Standard ACH (3-5 days)

Next day ACH (1 day)

Same day ACH (<1 day)

RTP payments, short for Real-Time Payments is one of the newest payment rails in the country, it is a payment processed in seconds.

Why is A2A good for the users?

For merchants: more clients, increased conversion rate, low costs, instant settlements

For consumers: better user experience, high level of security

Payments fraud is also something to consider, as A2A payments are significantly more safe than paper checks. Based on The AFP 2022 Payments Fraud Report, 66% of organizations we affected by check fraud, 37% by ACH fraud, and only 5% on A2A payment rails.

What is the future of A2A in the US?

The Fed is launching FedNow (Orum.io) in May-June 2023, which will be the first new payment system since 1970. Built on ISO 20022 standards, improving payment speed, traceability, and transparency. This will clear and settle payments on weekends, bank holidays and nighttime. The transaction limit is at $25k, so the solution is focused on SMBs, retail, and P2P payments.

The two major use cases for payments are payment (i) collection, and (ii) distribution. Each with different particularities and opportunities for disruption. For example, more specific A2A use cases based on Token, an open banking payment (distribution) platform from the UK:

Ecommerce payments

Fund accounts and wallets

Single, high-value payments

Subscription and recurring bill payments

Lower cost payments for credit card issues

Smaller one-time high value payments

Variable recurring payments (VRP), installments and BNPL

In the US, the credit and debit card adoption is already high, so naturally the space is much harder to disrupt, and with available solutions to transfer money A2A such as PayPal, Venmo or Zelle, it seems that the US could go through a different path than other regions. For example, in India, the central bank developed UPI:

UPI enables 2,348 transactions every second. The total UPI transaction value accounted for nearly 86% of India’s GDP in FY22. The UPI payment has revolutionized the payment system in India, something that even the US is far from achieving. Interestingly, the country has an extremely unique case study in the payment system - USA has a UPI problem

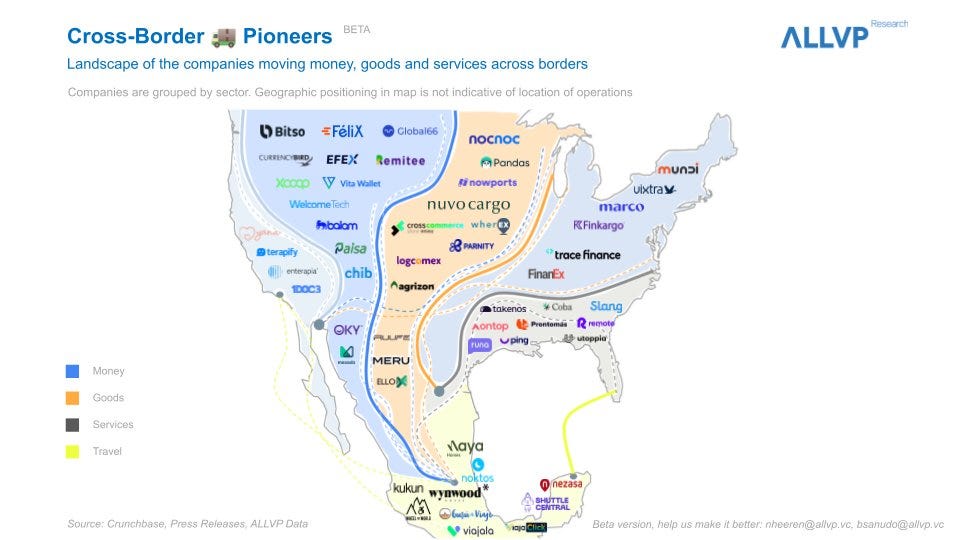

A2A Payments is beneficial at a domestic level, but crucial at an international level. This is a useful landscape of the cross border payments space, where we can see not only US solutions but also from other geographies as most of them are now tapping into different markets simultaneously.

What is the size of the payments market?

The total payments volume (TPV) in the US alone is $34 trillion, with $9 trillion in B2C payments and $25 trillion in B2B payments. Globally, there are $125 trillion in B2B payments. Assuming the same ratio of B2C to B2B payments as in the US, this means there are ~$45 trillion in B2C payments. That would mean a total global TPV of ~$170 trillion.

In 2021, the payments industry brought in $2.1 trillion in revenue. McKinsey projects that this revenue figure will rise above $3 trillion by 2026.

Source: Y Combinator

What is going on in LatAm?

LatAm has been moving toward digital payments technologies for the past two years with the rise of e-wallets and the trend of the cashless digital economy, but A2A solutions were unavailable in the region — until now. Brazil will be core focus given the status of open finance, you can get access to all banks partnering with one. Nevertheless, the focus or major concern is around regulations in LatAm and what happens if the rest of countries do not move like Brazil did.

A few charts to explain this:

(i) Important growth in Account-based transfers share (A2A)

Source: EBANX Report

(ii) Large gap in credit card vs account ownership across LatAm

Source: EBANX Report

Why is regulation so important?

Regulation is the central piece of the discussion today, and the Brazil Central Bank is leading by example. To learn more about their innovative approach to open banking, listen to Bruno Balduccini, from Pinheiro Neto Partner, a leading law firm in Brazil: “How Brazil became a global fintech leader and what other countries can learn from their success”. Some trends based on PIX in Brazil could essentially impact all LatAm if other central banks follow this open infrastructure movement:

Trend 1: PIX solutions as “guaranteed PIX” (BNPL) replace credit cards (e.g. Drip)

Trend 2: Data and fintech aggregators similar to those that already exist in the US

Trend 3: Stablecoin + PIX solutions for international transfers with less fees

When looking into regulation resources and solutions by country, there is a similar trend followed by different central banks regarding the use of new open-sourced technology to process payments without necessarily owning a bank account.

PIX - Brazil (Central Bank) - Pix is a payment method developed by the Central Bank of Brazil that enables transactions to occur in less than 10 seconds, 24 hours a day, 7 days a week – including weekends and holidays.

SPEI - Mexico (Central Bank) - SPEI is a system developed and operated by Banco de Mexico that allows the general public to make electronic payments, also called electronic transfers, in a matter of seconds through internet banking or mobile banking. This system allows you to transfer money electronically between bank deposit accounts almost instantly.

CoDi - Mexico (Central Bank) - CoDi is a platform developed by Banco de México to facilitate payment and collection transactions through electronic transfers, quickly, safely and efficiently, through mobile phones in a 24x7 scheme and at no cost.

PSE - Colombia (Central Bank) - PSE is a service that allows you to make your purchases and payments over the internet by debiting the online resources from your savings, current or electronic deposit account.

Yape - Peru (Banco de Crédito) - Yape is an application that allows you to make bank transfers through your cell phone, without the need to know the recipient's account number, just with the cell phone number of your contacts. It is owned by Banco de Crédito del Peru (BCP), so it is not an open finance solution yet (not owned by the Central Bank).

LatAm payments ecosystem on-track to disrupt credit and debit cards?

The recent McKinsey payments 2022 report says that in 5 years, A2A payments will surpass the use of credit and debit cards.

“A2A transaction revenues continued to increase their contribution in most geographies, in total accounting for roughly 29 percent of 2021’s rise in global revenue. The expansion of applications built on instant-payment use cases—such as bill payment, point of sale (POS), and e-commerce— fueled the volume increase. Growth varies by country, with Hong Kong, Colombia, and Peru registering increases of roughly 50 percent and a tier of countries including Nigeria growing in the 30–40 percent range” - McKinsey

How to process cheaper and faster B2B cross-border payments?

Every payment is account to account, but A2A is about how the account actually settles. The money moves from a seller to a merchant in a bank account transfer, a wallet settles from wallet to merchant account. In A2A, the payments settle over bank to bank, removing intermediaries. The main things to consider in A2A payments are reach, conversion, and cost. A2A has not broken through because of lack of reach, because it is difficult to access national clearance systems.

What is changing now and unlocking this? OBEP - online banking electronic payments - are companies that have hacked access to bank settlement rails. Companies that use a direct debit access to get clearance into the system through, others use screen scraping allowing you to log into your online banking, set the beneficiary, push the payment, all through an ecommerce flow. Others have done this through integration with the national clearance of each country. This solutions exist, but mainly through hacks on the financial system, so there is a big inflection point now as consumers and merchants would benefit from much lower cost, better reach through API (consistent A2A solution), and imminent settlements that give liquidity benefits.

Two ways to do this transfers:

Through the banking system rails: as explained above, this is a hack into the system and the risk here is to get blocked as it may not be an official integration and changing per country. Some examples here are companies such as Wise and Revolut in the US, and Global66 in LatAm. For cross-border payments, this flow requires having bank accounts on each country and balance accounts after each payment (corresponding banking).

Through fiat-backed stable-coins: using a wallet to transfer a payment through USDC and convert it back to dollars to finish the transaction. Some examples here are Bitso and Belvo. This transfers take seconds instead of days to do a settlement, but it is highly dependent on crypto wallet companies and there is no proprietary technology.

How to win in this B2B / A2A payments LatAm space?

As more companies continue to build new solutions around open finance / infrastructure in LatAm payments, it is important to understand how to win in a soon-to-be commoditized payments space. What is happening to payments today is similar to what happened to traditional phone calls a few years ago: calling was expensive through all carriers and networks, so you would limit the time on the phone as you could run out of minutes or get charged ridiculous fees. For international calls, this was even worse and it was seen as a privilege to be able to spend 5 minutes chatting with your family oversees.

But when WhatsApp came, things changed (especially in LatAm). No one uses phone calls anymore as you can WhatsApp Call your friends (or use FaceTime) with an unlimited 5G network provided by your carrier, or use wifi. Carriers had to adapt as more phone or video call solutions emerged (e.g. Zoom). Traditional banks and credit card vendors might have to do the same, re-thinking its payments business model and revenue streams, to offer an open network or base where other solutions can be developed.

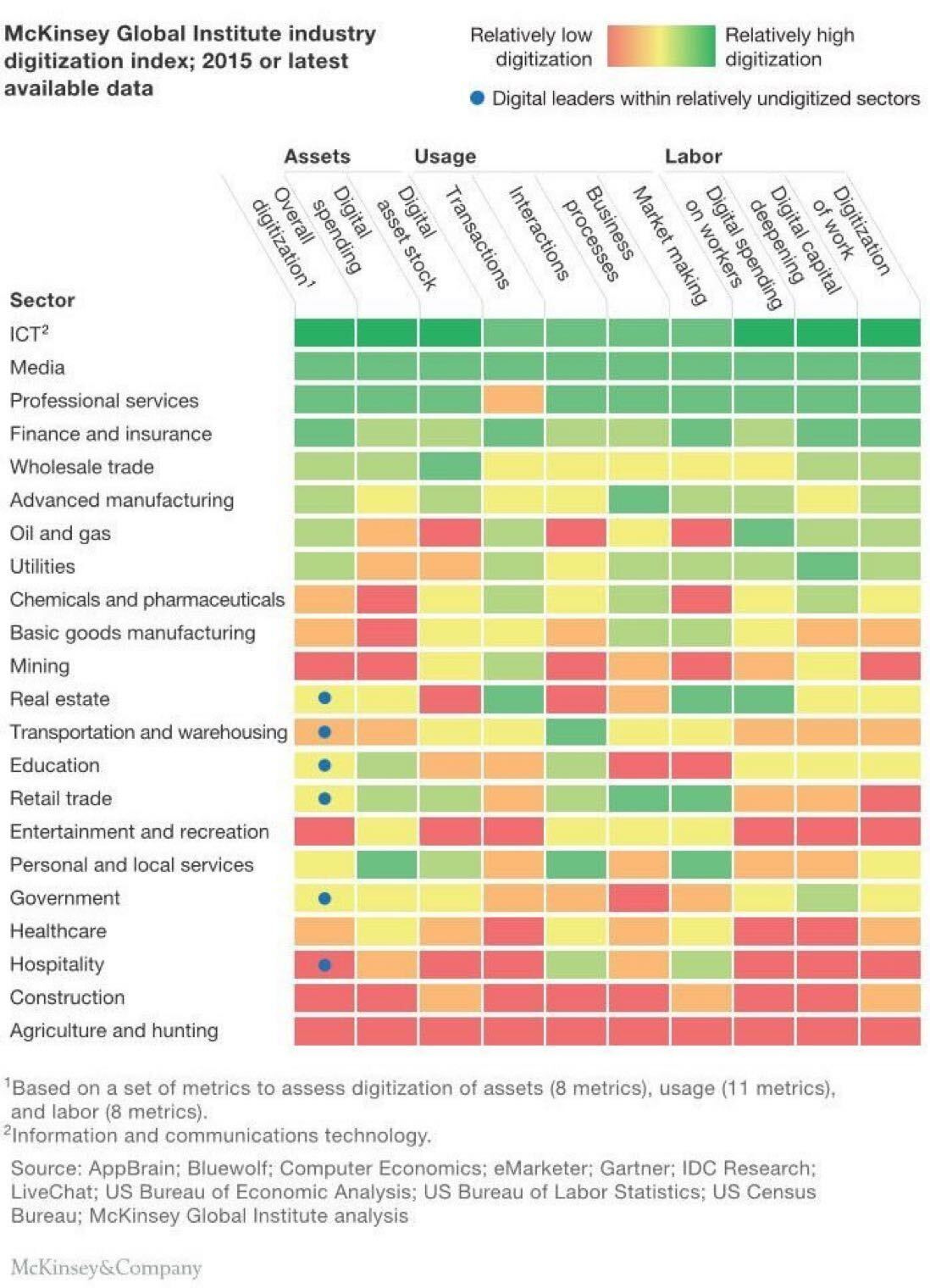

Startups, on the other hand, have to build a robust ecosystem of services (beyond just payments) to win a market and create stickiness. Also, some have to go vertical by specializing on a specific industry and pain point, or even focusing entirely on cross-border payments for a reduced number of countries and industries. In the coming months, we will see some vertical SaaS plays (and pivots) in the payments space, where the solution is targeted to a particular niche or industry-specific standards. This McKinsey report shows some vertical SaaS / Fintech opportunities by industry:

Finally, payments in LatAm will grow very much interconnected to the US, as more companies from the south part of the region grow their businesses and transactions with the north. With manufacturing companies from the US near-shoring or re-shoring to LatAm post COVID, the transaction value across countries will dramatically increase and we will see more solutions built around this corridor between Mexico/LatAm and the US. The larger opportunity is on US buying LatAm goods than other way around, as more traditional companies look to streamline payment workflows and improve liquidity, and visibility of payments coming their way.

Will a new player unlock this? Or an existing one pivot into this massive cross-border payments space? Some companies in the logistics space are strategically positioned to tap into this market. For example, Nuvocargo - company that is working around the digitalization of a large and traditional cross-border logistic operation between the US and Mexico - could follow Flexport’s (US benchmark) trade and working capital solution and build a payments feature on top of its initial logistics platform. The technology, pain-point, distribution and market is already there.

Some exciting early stage companies in the LatAm payments space (click here!)